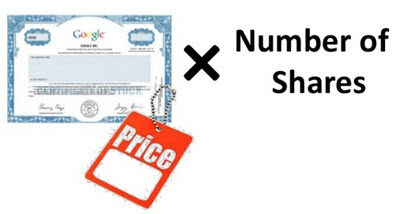

Market capitalisation is the value of all of a company’s stock shares. You can work it out by multiplying the number of outstanding shares by the price of the stock.

Why Is Market Capitalisation So Important?

Market capitalisation, or market cap as its known, is important because it gives potential investors a good idea of the size of one company compared to another, and so the potential for investment as well. It gives a reasonable measurement of how much a company is worth, in addition to the future potential for the company, because it gives a good indication how much investors are prepared to pay for the company’s stock.

Market capitalisation, or market cap as its known, is important because it gives potential investors a good idea of the size of one company compared to another, and so the potential for investment as well. It gives a reasonable measurement of how much a company is worth, in addition to the future potential for the company, because it gives a good indication how much investors are prepared to pay for the company’s stock.

Large-Cap Companies

These are companies with high market capitalisation, and with a market value in excess of $10 billion. These companies have a fine reputation, are well known for producing quality goods and services, and have a history of stable growth and making dividend payments at regular intervals. These are household companies which are familiar to most people on the street. Because of this, investments in stocks in such companies may well be thought of as quite conservative, certainly more so than they would be in small-cap or Mid-cap Company.

Mid-Cap Companies

These companies attract a lower value than large-cap companies but are still fairly high in value, normally between the $2 billion and $10 billion marks. They are companies that are pretty well known to many people and are usually going through a period of significant growth. It could well be a ‘make or break’ time for the company, with the coming months determining whether the company will be a true success or not. They normally attempt to increase their overall market share and competitiveness. In terms of investment, they offer more potential for growth than large-cap companies and are probably less risky than small-cap companies.

Small-Cap Companies

These companies are normally those in industries that are emerging and markets that are niche. Normally the market values of these companies are somewhere between the $300 million and $2 billion mark. They are considered riskier than large-cap or mid-cap companies because they are more prone to fluctuations in their performance.

These companies are normally those in industries that are emerging and markets that are niche. Normally the market values of these companies are somewhere between the $300 million and $2 billion mark. They are considered riskier than large-cap or mid-cap companies because they are more prone to fluctuations in their performance.

Influences on the Market Cap of a Company

In reality, several factors can influence the market cap of a company. Changes in the values of a company’s shares – whether that is up or down – can have an impact, as can the number of shares issued by a company. The volatile nature of the economy can also have an impact, especially on low-cap companies.

If you’re truly serious about building up a comprehensive, varied portfolio of stocks, it’s a good idea to have as diverse a portfolio as possible – that is one with a good mixture of stocks from small-cap, mid-cap, and large-stock companies. By doing this, you can reduce the general risk of having stocks and support your goals in financial terms.

This article was last updated on: January 16, 2018